Tapiola Bank

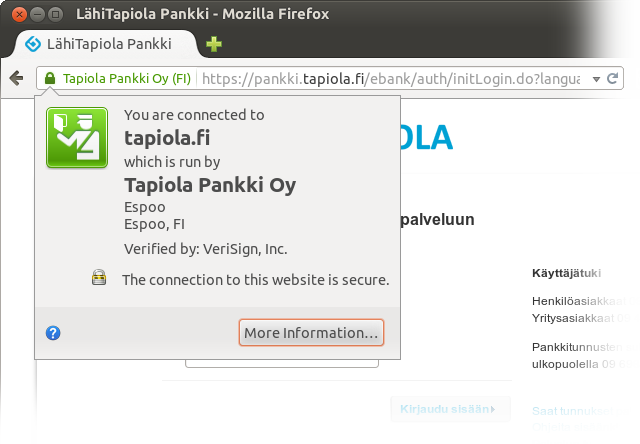

In this page you will find detailed information about the swift code “ TAPIFI22XXX ” of “ TAPIOLA PANKKI OY ”. What is a SWIFT code? SWIFT codes are used to identify banks and financial institutions worldwide. They are used by the swift network to transmit wire transfers (money transactions) and messages between them. Currently known as LahiTapiola, the Tapiola Bank Ltd is the Finish bank, part of the Tapiola Group. Initially, it offered insurance services but later acceded to the banking trade in the year 2004 with the Tapiola Bank. Some of the services offered by Tapiola Bank include the following. LocalTapiola in brief LocalTapiola launched operations officially on 1st of January 2013. In addition to LocalTapiola General and the regional companies, the Group comprises of LocalTapiola Life, LocalTapiola Asset Management and LocalTapiola Real Estate Asset Management. Banking services to LocalTapiola's customers is provided by S-Pankki.

S Bank and Tapiola Bank merge to form a new S Bank. S Group owns 75 per cent and the LocalTapiola Group 25 per cent of the new bank, which will start operations in 2014.

S Group and LocalTapiola have simultaneously concluded a Letter of Intent regarding the relaunch of bonus partnership after an intermission of a few years. The intention is to start bonus cooperation as regards insurance in the beginning of June 2014.

In addition, the parties have concluded a Letter of Intent concerning the deepening of S Group and LocalTapiola strategic cooperation. New forms of the cooperation will be explored during the autumn.

With the banks’ merger, offering to the customer-owners of the retail co-operatives will extend to secured loans. Correspondingly, the customers of LocalTapiola will get an option of more versatile banking services within a service network that is significantly more extensive than the current one.

— The balance sheets of the merging banks complement each other very well and together, the banks form a larger entity, which has better operational preconditions than separate service providers, emphasises SOK’s Chief Executive Officer, Kuisma Niemelä.

Despite its increased resources, the new S Bank intends to pursue controlled, moderate and profitable growth as regards housing loans and other secured credit granting. In contrast, stronger growth is the target in basic banking services, consumer credit, mutual fund operations and asset management.

As part of the merger of the banks, LocalTapiola Asset Management’s asset management operations and mutual fund operations will diverge. Mutual fund operations will be transferred to S Bank’s future subsidiary, FIM Asset Management Ltd, forming Finland’s fourth largest mutual fund company. LocalTapiola’s asset management company will continue under the 100 % ownership of LocalTapiola, and no changes will occur in the position of its asset management customers or the services offered to them. LocalTapiola Asset Management will be responsible for the portfolio management of mutual funds carrying the LocalTapiola name also after the merger.

— The new S Bank and the cooperation between S Group and LocalTapiola will create and strengthen the operational preconditions of our regional companies. The cooperation of two customer-owned and regionally strong groups will create new kinds of added value to the customers in both services and benefits, says President of Local Tapiola Group, Erkki Moisander.

The merger of the banks into a new S Bank still requires Financial Supervisory Authority’s, as well as Competition Authority’s and Consumer Agency’s permissions. In addition, the new bank must apply for a banking licence of its own.

Additional information:

SOK, Jari Annala, Director, CFO, Chairman of S Bank’s Board of Directors, tel. +358 10 76 82040 (banking and asset management)

SOK, Director Harri Miettinen, tel. +358 10 76 80230 (bonus cooperation and strategic cooperation)

LocalTapiola, Erkki Moisander, President, tel. +358 20 522 2478 (bonus cooperation and strategic cooperation)

LocalTapiola, Harri Lauslahti, Group Director, tel. +358 9 453 7100 (banking and asset management)

What is a SWIFT code?

SWIFT codes are used to identify banks and financial institutions worldwide. They are used by the swift network to transmit wire transfers (money transactions) and messages between them. For international wire transfers, swift codes are always required in order to make transactions secure and fast.

These codes were initially introduced by the SWIFT organization as “swift codes” but were later standardized by the International Organization for Standardization (ISO) as “BIC” meaning “Business Identifier Codes”. Most people think B.I.C. stands for “Bank Identifier Codes” (“bank” instead of “business”) but that is incorrect since non-financial institutions can also join the swift network.

A “BIC code” can be seen by many different names, like “SWIFT code” (most common), “SWIFT ID”, “SWIFT-BIC”, “SWIFT address”, “BEI” (that comes from “Business Entity Identifier”), or even “ISO 9362”, which is the standard format that has been approved by the ISO organization. The acronym SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication.

In depth analysis of a swift code

Swift codes are broken down into sections, in the same way telephone numbers are broken into sections, and every section reveals some information about the institution that was assigned this code. They consist of eight or eleven characters. Whenever an eight-character code is used, then it is referring to the headquarters (main office) of the institution.Here is how an 11-character code is broken down and what each section of characters represents. Let's take this imaginary 11-character swift code:

It can be broken down to these sections:

Tapiola Food Bank

Section 1 (the first 4-characters “AAAA”): This code is used to identify the institution’s global presence (all branches and all divisions around the world). For example, “CHAS” is used for “JPMORGAN CHASE BANK”

Section 2 (5th and 6th characters “BB”): This two-letter code represents the country of this particular institution’s branch and follows the ISO 3166-1 alpha-2 standard for representing country codes. For example, “US” for “UNITED STATES”, “GB” for “UNITED KINGDOM”, CA for “CANADA”, etc.

Section 3 (7th and 8th characters “CC”): These characters represent a location code (e.g. “FF” is the code for “Frankfurt”, “KK” is the code for Copenhagen, etc.) and also the second character (8th in the B.I.C.) sometimes carries this information:

- If it is equal to “0”, then it typically is a BIC assigned for testing purposes (as opposed to a BIC used on the live network).

- If it is equal to “1”, then it denotes a passive participant in the SWIFT network.

- If it is equal to '2', then it typically denotes a “reverse billing” BIC, meaning that the recipient of the message has to pay for the message.

Tapiola Private Banking

Section 4 (9th to 11th characters “DDD”): These final three characters form a “branch code” that refers to the particular branch of the institution. If this section is omitted, then we have an 8-character swift code that is assumed to refer to the HEAD OFFICE of the institution. Also, a typical naming convention is that in the case we are referring to the main offices of an institution, this branch code is “XXX”.

Tapiola Op Bank

Some popular swift code searches:

- Bank of America swift code: Bank of America BOFAUS3NXXX (or simply: BOFAUS3N)

- Chase swift code: JP Morgan Chase CHASUS33XXX (or simply: CHASUS33)

- HSBC swift code: HSBC Bank PLC MIDLGB22XXX (or simply MIDLGB22)

Tapiola Pankki

Try our online SWIFT/BIC lookup tool to locate any of the thousands active or passive swift codes. Our primary focus is to provide you with the most accurate and up to date database of financial institutions all over the world. You can search for an institution’s detailed data by entity name, BIC, or even specific keywords that narrow the search results even more. You can also browse for swift codes by clicking on the list of countries and then choosing the institution's name from the alphabetical list.

Tapiola By Sibelius

We are certain that this site will help you save a lot of time (hence... money!), especially if you are dealing with lots of bank transactions daily. Please read our disclaimer at the bottom of this page before using our online tool.