Using Cash App For Bitcoin

- Buying Bitcoin on Cash App – Bitcoin On Cash App If you do not already have the app, you can download it from the App Store or Android Play Store. Next, open the app and pick the preferred mode, either cash, dollars or BTC. If the options don’t show, swipe left or click on the BTC symbol at the top right-hand corner.

- Open your Cash App, Select the profile icon in the upper-left. Scroll to Funds and Select Bitcoin. Before you can withdraw your funds, you will need to verify your Identity. Once you’ve verified your identity, Select “Transfer Out” and Press Confirm.

First you have to download the Cash App from the Android or Apple app store. Download Here

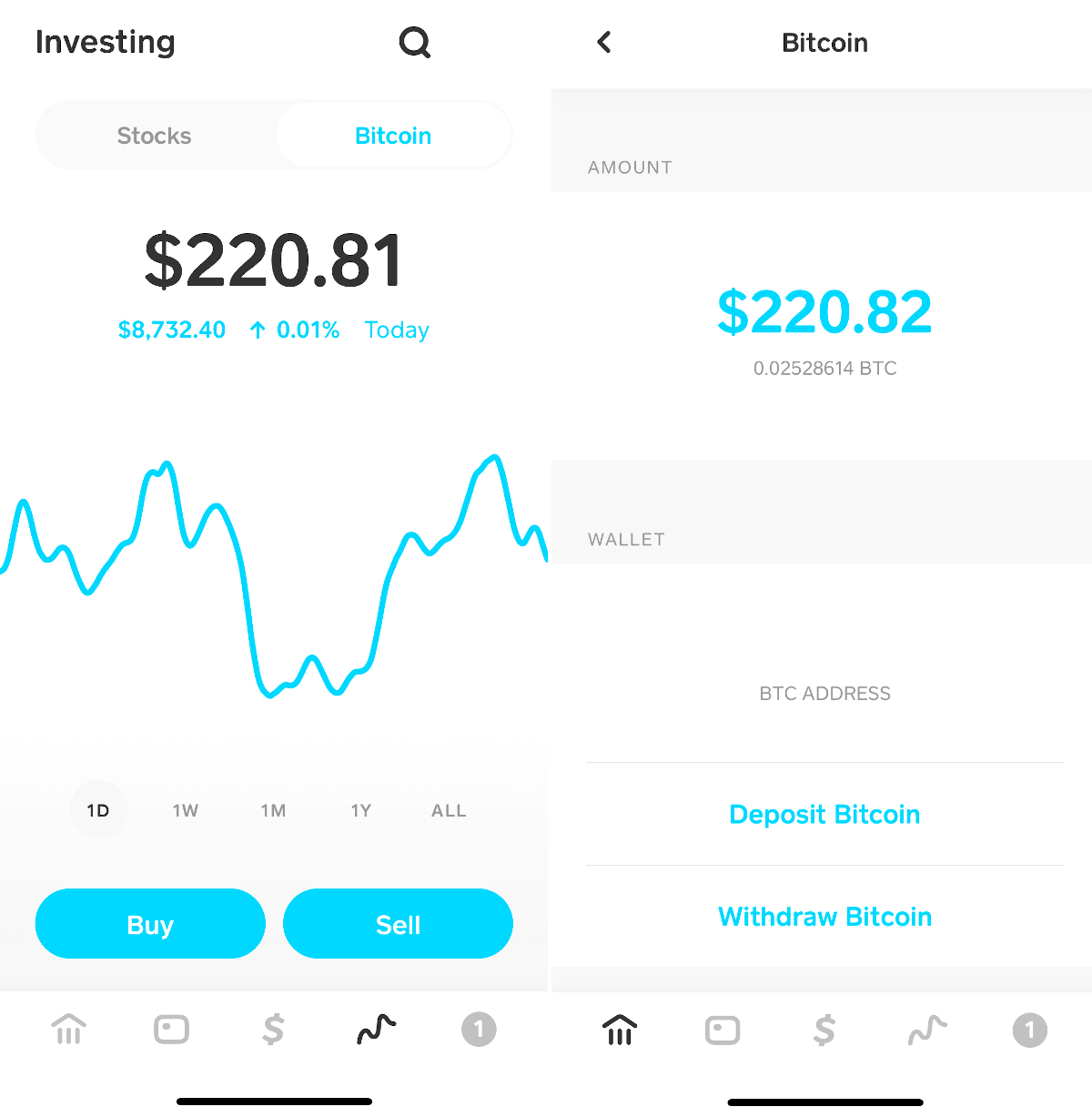

To Buy Bitcoin (BTC) in Cash App:

1. Open your Cash App, select Cash & BTC or the dollar amount at the top of your screen.

2. You can swipe left or select the BTC symbol in the upper right-hand corner.

3. Select Buy, you can use the slider or swipe up to enter the amount you’d like to purchase. Press Buy BTC.

To get started with using Cash App to buy bitcoin you first need to download the app from the Apple App Store (iPhone only) or Google Play Store to your tablet or smartphone. After signing up and linking a payment method whether a bank account or debit card, you get to choose a unique name for your account known as a Cashtag which also allows. Therefore, after you have purchased Bitcoin using the app, you may wish to withdraw the coins to an external crypto wallet. The problem is how to carry out Cash App Bitcoin withdrawal. In this article, we will show you how to withdraw Bitcoin from Cash App. It takes just a few minutes to withdraw your coins, and here are the steps to follow.

4. Enter your Cash pin or use your Touch ID for security. Press Confirm.

Note: Before you can purchase Bitcoin (BTC) Cash App will pull money into your balance. They may require you to enter some additional identification information.

To Sell Your Bitcoin (BTC) in Cash App:

1. Open your Cash App, select Cash & BTC or the dollar amount at the top of your screen.

2. You can swipe left or select the BTC symbol in the upper right-hand corner.

3. Select Sell, you can use the slider or swipe up to enter the amount you’d like to sell. Press Sell BTC.

4. Enter your Cash pin or use your Touch ID for security. Press Confirm.

FAQ

How much does buying and selling Bitcoin cost?

Cash App does not charge an additional percentage or fixed dollar amount. They use a price calculated from the quoted mid-market price, inclusive of a margin or speed. The mid-market price is a combined price of BTC across major exchanges to give the user an average price.

Note: When you buy Bitcoin (BTC) from Cash App, the margin may differ from when you sell Bitcoin (BTC) to Cash App. The price and margin may also be different from other exchanges/marketplace.

Can you send Bitcoin (BTC) to an External Wallet?

Yes! To withdraw your Bitcoin to an external wallet follow the steps below:

- Open your Cash App, Select the profile icon in the upper-left.

- Scroll to Funds and Select Bitcoin.

- Before you can withdraw your funds, you will need to verify your Identity.

- Once you’ve verified your identity, Select “Transfer Out” and Press Confirm.

- Scan the QR code from your external wallet or select “Use Wallet Address” at the bottom of your screen.

- Press Confirm.

Note: Once you’ve processed your withdrawal in Cash App, your Bitcoin (BTC) will be sent to your external wallet. Transfering Bitcoin (BTC) can take time, so please allow up to a few hours for the transfer to complete.

You may like

The United States passed into law its Anti-Money Laundering Act of 2020, which takes effect on January 1, 2021. This brings digital currency exchange companies and other digital-asset-related businesses under the scope of regulations of the Bank Secrecy Act (BSA), which requires financial institutions “to actively detect, monitor and report potential money laundering activity.”

“I’m pleased that our anti-money laundering legislation was included as a part of this year’s [National Defense Authorization Act]. This bipartisan legislation protects Americans by depriving criminals and terrorists of the tools they use to finance illicit activity. It is the first serious overhaul of our anti-money laundering system in decades, and it makes sense to include it in the biggest, most important national defense legislation Congress passes each year,” South Dakota Sen. Mike Rounds said in a press release.

The massive anti-money laundering reforms are targeting businesses dealing with digital currencies and assets by clearly specifying the definition of a “financial institution” to “‘a business engaged in the exchange of currency, funds, or value that substitutes for currency or funds” and “a licensed sender of money or any other person who engages as a business in the transmission of funds or value that substitutes for currency.”

The reforms further define a “money transmitting business” to include those who deal with “currency, funds, or value that substitutes for currency.” Now, there are no longer loopholes that digital asset companies can use when dealing with the Financial Crimes Enforcement Network (FinCEN), the agency that enforces the BSA.

Stricter Penalties Enforced

Aside from updating definitions to ensure that digital currency exchange firms and others dealing in digital assets are clearly within the scope of the AML Act of 2020 and the BSA, stricter penalties are now being enforced for crypto criminals.

Now, those who have been found guilty of violating the AML Act of 2020 and/or BSA are faced with fines amounting to profits earned while committing the violation and possible jail time. Those guilty of an “egregious” breach are also going to be banned from taking a board member position of any financial institution in the country for 10 years. Furthermore, employees of financial institutions who commit these crimes will be obligated to return to their employer all bonuses received during the time the act was committed.

FinCEN is being given additional resources, like increasing its manpower, to ensure the enforcement of these reforms. This will further safeguard investors against crypto crimes and nail down digital currency exchange firms and other digital-asset-related businesses that do not comply with BSA regulations.

Less than two months into 2021, the price of bitcoin has risen 95.4%.

Based in the United States and want to trade via Binance.US? Click here to sign up now!

Charles Hoskinson has always been a huge advocate for decentralized finance and building a network that could provide solutions to the problems with our current financial and banking systems. In this recent AMA Charles speaks out on his view about the issues that Bitcoin faces as well as reminding everyone that cryptocurrency isn’t all about taking profits.

Despite Charles Hoskinson open criticisms of Bitcoin he does say:

“I would still be working on Bitcoin if Bitcoin could evolve”

Using Cash App For Bitcoin

Trending

As mentioned in our previous post on the subject, buying bitcoin with Venmo is difficult, while buying bitcoin with Square Cash, its rival, is not.

Like Venmo, Square Cash is an app you can use to send money to your friends. Unlike Venmo, Square Cash comes with a built-in bitcoin wallet.

Square’s founder and CEO, Jack Dorsey (who also founded Twitter), is a big bitcoin bull. Last year, he said that he thinks bitcoin will become the world’s currency and the currency of the internet. Take a look at this tweet to get his feelings on Square Cash and bitcoin.

In November 2017, just as the price of bitcoin was taking off, Square Cash began experimenting with bitcoin trading. Following this, the price of bitcoin increased by 11%.

In January 2018, Square gave its users the ability to buy and sell bitcoin within the Cash app.

According to Square’s quarterly financials, bitcoin trading brought in $43 million in revenue during the most recent quarter.

“We consider our role in the bitcoin transactions to be facilitating customer access to bitcoin,” Square wrote in its quarterly report.

Venmo, which is owned by PayPal, is not nearly as bitcoin-friendly. Dan Schulman, PayPal’s CEO, called bitcoin “unsuitable” last year.

Here’s how to buy bitcoin with Square Cash.

Step 1: Download Square Cash

If you are using an Apple device, go to the App Store. If you are using an Android device (such as a Samsung phone), go to the Play Store.

Search for “Cash”, and download the app.

Step 2: Open the Square Cash app

You’ll then see this screen. Tap on the little circle in the top left corner.

Step 3: Link your bank account

Link your bank account using your debit card. Enter your 16-digit debit card number, along with your card’s expiration date, the 3-digit CVV, and your Zip code. Then tap “Add Card”.

If you don’t have a debit card, tap “No Card?” and enter your bank’s 9-digit routing number.

Step 4: Tap on “Bitcoin”, then tap “Buy”

Step 5: Enter the amount of bitcoin (in dollars) that you wish to purchase

Step 5: Press “Buy”

That’s all there is to it! You have now successfully bought bitcoin using Square Cash.

In Conclusion

Buying bitcoin with Square Cash is very simple.

Using Cash App To Buy Bitcoin

Moreover, Square Cash is catching up with Venmo. According to eMarketer, around 22.9 million people used Venmo in 2018, while 9.5 million people used Cash. However, according to Nomura, Cash has been downloaded more than Venmo.

If you are a bitcoin enthusiast, Square Cash is probably the better choice.

For more high-quality content on bitcoin and other digital currencies, subscribe to the Bitcoin Market Journal newsletter today.